Loans

$1MM – $10MM Commercial Loans

We provide commercial loans to successful entrepreneurs for all types of reasons. Typical loans include:

Acquisitions

Acquisition loans can help your company buy another business or cover significant capital expenditures.

Growth

Loans for the purpose of fueling growth including inventory, equipment, marketing, expansion, new facilities, and product development.

Recapitalization

Loans help align your balance sheet, professionalize your financial picture, enable acquisitions, or enhance the sales price of your business.

Owner Payments

A loan to owners can allow you to buy out a partner, fund dividends or achieve other objectives in your life. Prudent debt can provide liquidity without dilution or change of control.

Special Situations

Each one of our clients has a special set of circumstances. We work to find the right lending solution for each of their businesses.

“During Covid we had a downturn that impacted our bank loan covenants. When we needed our bank most their regulations made it impossible to work with them. Pasadena Private stepped in and very quickly provided us with the capital we needed to maintain our business. We are back to growing thanks to Pasadena Private Lending.”

President of an electronics assembly/distribution company

Traditional Loan Terms

Interest Rates

Floating Rate

Floating rate loans with margins of 3% – 7% over US Prime Rate

Loan Structure

Term Loans & Lines of Credit

1 – 5 year maturity terms

2 – 10 year payment schedule

Typical Fees / Expenses

Loan Origination Fees of 1% – 2%

Up to 20% of our overall commitment can be structured as a revolving line of credit.

Our Requirements:

- Must be a corporate / LLC borrower

- No startup firms

- No other senior secured debt (we can refinance existing senior secured debt prior to funding our loan)

- First lien on sufficient assets or demonstrated sufficient cash flow and/or a meaningful personal guarantee

- Credible business plan

- Typically guaranteed by owner(s)

Customized Loans to Fit Your Needs

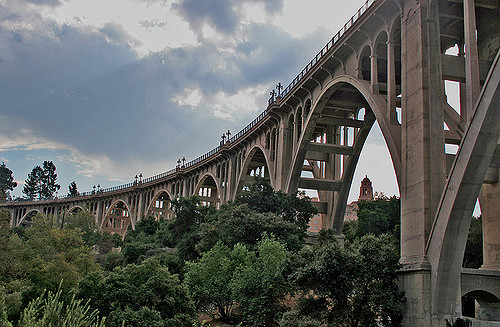

Pasadena Private Finance is a privately-funded commercial lender offering competitively priced loans to established borrowers who value speed of execution, customized loan terms and streamlined documentation.

We are not a bank. We are experienced former commercial bankers, tired of jumping through hoops to get our loans approved by remote and skeptical credit committees, who believe there is a better way of doing business. We set out to create a firm that “makes loans that make sense” for entrepreneurs with a good reputation.

Nor are we “hard-money lenders” charging exorbitant rates and focused on collateral liquidation values. Our interest rates are typically around 3% – 7% over Prime and we can offer all of the usual structures found at traditional banks. Unlike banks and hard-money lenders however, our loans come with significantly less strings attached because we prefer to rely on your acquired knowledge, your entrepreneurial drive and your personal character than on fine print in a legal document.

We believe that successful entrepreneurs are looking for financial partners who can help them grow their business with attractively priced debt, and that they are ready to ditch their traditional bank for a responsive and creative lender who understands their business and values their track-record. We partner with successful and established entrepreneurs who need between $1 MM and $10 MM of debt to take their business to the next level. Because we are not FDIC-regulated, we can lend outside of the traditional banking silos and underwrite to pro-forma metrics rather than to often meaningless historical results.

We understand that debt can be more than just a cost of doing business: structured the right way, it can be an opportunity to increase enterprise value, and ultimately, your net worth.

Ready to get started?

Start the process to get a loan now.